- January 19, 2023

- Economic Mobility

In 2012, Jonathan Mintz launched the Cities for Financial Empowerment (CFE) Fund, a 501c(3) corporation with a mission to “leverage municipal engagement to improve the financial stability of low and moderate income households.” Based on the successful Financial Empowerment Center model he developed in New York City in 2008, which provided free, one-on-one professional financial counseling and coaching for low-to-moderate income residents, the new CFE Fund sought to expand this work in cities and counties nationwide. The organization works in partnership with municipal governments by providing “funding and focused technical assistance to mayors and their teams to help them embed systemic financial empowerment programs and policies into existing city services.”

At the same time the Lansing, Michigan, city government wanted to address income disparities and lift up residents living below the federal poverty line. Local leaders applied to be part of the initial cohort of CFE Fund cities and in 2013 – shortly after the Fund launched – Lansing was chosen as one of five municipal governments to replicate and scale the FEC model in their cities.

Lansing utilized a unique approach, launching an Office of Financial Empowerment (OFE) within the Mayor’s office, to make financial empowerment for low-to-moderate income residents a core city service. Additionally, Lansing leveraged geographic information system (GIS) and mapping tools to focus and advance their financial empowerment initiatives.

Amber Paxton, the inaugural OFE director, played a key role in developing the CFE Fund grant proposal and took the lead in launching both the new OFE and the FEC model in January 2013. A broad range of residents came to her team seeking assistance. Paxton said that “on any given day, we help[ed] residents from all over the city with all different racial, ethnic, and economic backgrounds,” and the OFE’s “typical” clients had an average annual income of $15,000. Many residents were experiencing homelessness, while others were justice system-involved residents reintegrating after incarceration.

Immediately, Paxton looked to mapping tools help with two key roles:

1. Strategic Planning

From day one, Paxton’s team knew the importance of understanding how location and geography impact the financial situations of residents. “We cannot effectively serve the residents without understanding more about who they are and where they are located,” she explained. Since the early days of the OFE launch, staff have relied on GIS and mapping tools to conduct in-depth research on Lansing’s 118,000 residents living across the city’s 86 formal neighborhoods. “Each neighborhood is like its own microcosm. The neighborhoods on the far east side of Lansing are a completely different planet from the far west side. You have to know them both,” said Paxton, “We have a mandate as city government to serve everyone, and we can’t know everyone without digging into the location data.” This has led to more effective targeting of financial services programs.

2. Funding

Beyond strategic planning, GIS and mapping tools have been incredibly powerful for helping the OFE make the case for new programs and initiatives. Whether it is city residents, donors and funders, business leaders, or the Mayor and City Council, the OFE team always comes ready with maps. “Whenever we want to make the case for our programs, we create maps to not only articulate the challenge, but personalize it so our audience can see how the challenge impacts their neighbors, or in the case of City Councilmembers, their Wards,” Paxton said, noting that this has been incredibly impactful, leading to increased funding for OFE programs.

Looking back on the past ten years, Paxton highlighted a few innovative ways her team has leveraged GIS and mapping to target financial services to Lansing residents.

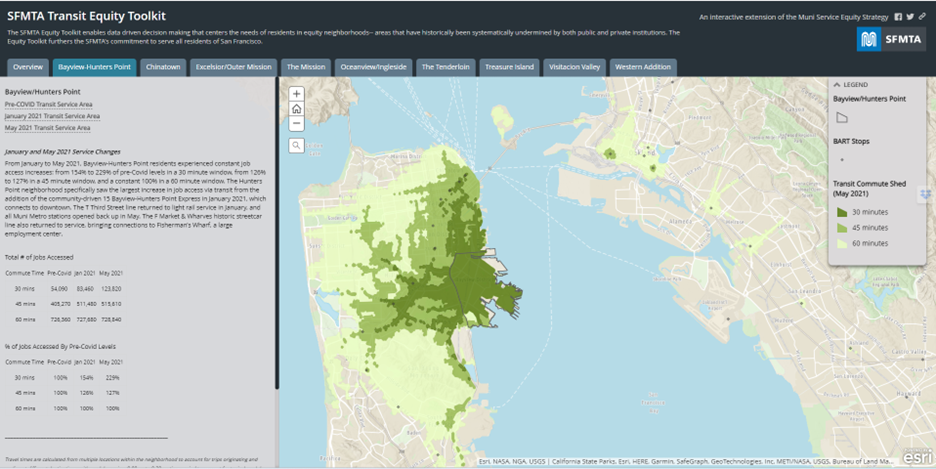

Strategic placement of service locations

In 2012, Paxton and her team developed the first test case for using maps to target financial services to Lansing residents. She partnered with several city departments and external entities such as the county treasurer and FDIC to map banking status, property tax foreclosures, and poverty to understand where the most financially vulnerable residents lived. A heat map identified a wide, straight line down the middle of the city along a major bus route, offering an opportunity to strategically place five FEC service locations that would be convenient for residents to access. During the recovery from the Great Recession, it was critical that residents most impacted by the economic crash could get to a service location and gain access to financial services.

Investing in underserved communities

In 2015, Paxton partnered with the County Health Department on a grant funded by the Robert Wood Johnson foundation to address the social determinants of health in underserved communities. As part of this effort, Paxton worked with the county to map “banking deserts” in Lansing, or neighborhoods with no or very limited access to a bank branch. Using GIS, the team was able to show that southwest Lansing only had one bank branch in the entire region – but had a payday lender for every 300 residents. Using this data, the County was able to leverage grant funding to target investments in the South Lansing communities.

Another underserved community was the population of parolees, folks re-establishing themselves after a period of incarceration. The FEC identified a lack of financial education and banking, coupled with high debt and low credit scores, among justice-involved residents and decided to provide financial counseling in dedicated parolee housing. According to the preliminary data published by the Fund, this counseling helped parolees find their own, independent housing more quickly than the folks who had been in transitional housing previously, without access to the FEC.

Hyper-localized fundraising

Also in 2015, the OFE partnered with local credit union and several nonprofits to initiate the Lansing SAVE program, a college savings account program for kindergarten students funded in part by the OFE (via the city’s general fund), plus local donors and parents. This program is still active, encouraging students and their families to save up for college and invest in their future.

In 2018, Paxton and her team presented location data on the Lansing SAVE program at a community meeting organized by Pastor Matt Smith in the Baker neighborhood. They showed how many children in the area around the church had a college savings account and what their average account balances were. Following the meeting, the pastor approached the team and offered to periodically collect donations for the students in his surrounding community.

He became the first “Community Champion” of the Lansing SAVE program and, over time, the OFE has been able to map the difference in average account balances for the students with and without a Community Champion, showing that students with a Community Champion have average account balances four times larger than those without (and nearly five times higher in the Baker neighborhood thanks to Pastor Smith). Currently, there are 400 students in the city that are supported by one of three Community Champions and, to date, the effort has raised about $8,000 per year.

The OFE is now using this data to recruit more Champions and to hyper-localize fundraising for the Lansing SAVE program. Soon Paxton hopes to build a map-based fundraising tool that will allow potential funders to identify and select neighborhoods where they want their money to go.

In Lansing, the FEC model has been tremendously impactful. OFE credits data mapping with playing an incredibly important role in enabling the program’s successes. For any local leaders hoping to replicate this work, Paxton encourages them to start with the data they already have. She explained that “local governments have mountains of data to work with, but they often don’t bring that data together to get a complete picture of what is happening in the city. Find out what you already have and dive into the data to get a baseline understanding of the information already at your fingertips.”

Paxton noted that this can be a lot of work but, with patience and persistence, digging into the data can go a long way in improving outcomes for residents. “Take good enough until you can get better,” she said, “the residents that need you the most just need you to start somewhere.”