- Map

- United States

- Esri

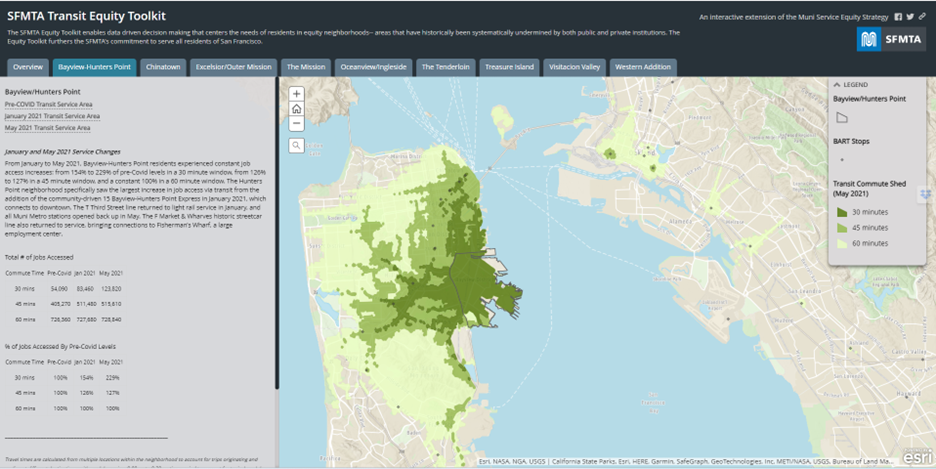

Using 2017 demographic data, the map analyzes changes in American affordable housing between 2012 and 2017 and the current state of affordability for every American county. The map draws upon Esri’s Housing Affordability Index (HAI)—a measure that takes into account median household income, median home value, and mortgage rates—in order to understand the effect of demographic change on local affordability and vice versa. Esri’s approach to measuring housing affordability uses an index to quantify the ability of a typical resident to purchase an existing home in an area. Employing the national average contract mortgage rate from the Federal Housing Finance Agency, an interest of 4.2 percent is estimated for Esri’s 2017 Housing Affordability Index model. A 30-year mortgage is assumed with a down payment of 20 percent of the home price. Regional property tax rates are determined from the latest American Community Survey and Esri’s model follows the Federal Housing Administration’s guidelines for debt service ratios. This map reminds policymakers that in times of rapid population growth, they must facilitate the development of new, affordable housing—whether through zoning or financial incentives for developers. By highlighting areas that have experienced rapid population growth and maintained affordability—cities like Houston, Raleigh, NC, and Midland, TX—the story map showcases potential models for replication.

DATASETS

Esri’s Housing Affordability Index (HAI) and Esri Demographic Data, based on the U.S. Census Bureau American Community Survey, Federal Housing Finance Agency data, and Federal Housing Administration data